Unlock the secrets of a company’s financial health with our beginner’s guide on how to read financial statements. By learning to analyze balance sheets, income statements, and cash flow statements, you’ll gain the power to make informed decisions for investing or planning your next business move. This guide will help you understand the connections between these statements, empowering you to uncover the stories hidden within the numbers.

AdvertisementKey Takeaways

- Grasp the significance of liquidity ratios in evaluating a company’s immediate financial health.

- Discern between the impacts of long-term and current liabilities on a company’s financial solvency.

- Understand the role of different components of owners’ equity and how they contribute to the net worth on a balance sheet.

- Learn how asset valuation methods like fair value and historical cost affect financial reporting.

- Recognize the importance of transparency and comparability through the notes appended to financial statements.

- Appreciate the distinction between current and non-current items on the balance sheet to gauge a company’s near-term and long-term obligations.

The Importance of Financial Statements in Business Analysis

Learning the financial reporting basics and how to read financial statements is key today. They show a company’s growth, strategies, and risks by looking at their finances. To do this, you need to know about accounting and follow the rules from the Financial Accounting Standards Board (FASB).

Insight Into Company Health and Potential Investment Opportunities

Financial statements are very important to investors and stakeholders. They show a company’s financial health through balance sheets, income statements, and more. These documents help see if a company is doing well and is profitable. Large companies’ financial statements are detailed, showing challenges and chances for those who analyze them well.

Different people, like owners, managers, and potential investors, use financial statements. They depend on the reports following GAAP for clear and correct data. By using metrics like ROA and ROE, you can measure a company’s financial skills. Horizontal and vertical analysis helps understand financial trends and the company’s health over time.

Necessity for Strategic Decision-Making Across Business Levels

Financial statements are not just for looking back; they guide future business strategies. They help check income, manage expenses, and understand cash flows. They’re essential for strategic planning. Looking at financial statements helps leaders make smart choices and plans.

Not only big companies but also individuals use financial documents for various reasons. Companies might share extra useful data, improving reporting and planning. Being able to understand different accounting principles, like GAAP and IFRS, is crucial for comparing international companies. This strengthens investment decisions.

Finally, ratios like asset turnover, quick ratio, and profit margins show how well a company is doing. These, with strategic analysis and knowing the financial world, give a full view of a company’s worth. This helps in making wise financial choices looking ahead.

Could this be of interest to you? “The Ideal Order of Financial Statements for Analysis”

How to Read Financial Statements for Effective Cash Flow Analysis

Understanding how to read financial statements is key, especially the cash flow statement. Seeing how income statements and cash flows relate is essential. We’ll examine Acme Manufacturing’s 2020 finances, following strict financial reporting standards.

- Compare to Prior Periods: Analyze changes over time to understand trends and financial performance.

- Compare to Competitors: Compare financial statements to those of other companies in the same industry to evaluate performance relative to peers.

- Use Ratio Analysis: Apply ratio analysis to evaluate a company’s financial health and performance, such as solvency ratios and investor ratios.

| Financial Aspect | Amount | Remarks |

|---|---|---|

| Net Income | $138,100 | The bottom line from the income statement |

| Depreciation (Operations) | $55,500 | Non-cash expense added back to cash from operations |

| Increase in Accounts Receivable | ($13,000) | Reduction in cash flow, signifying credit sales |

| Increase in Accounts Payable | $12,000 | Improvement in cash flow, indicating delayed cash outflows |

| Increase in Taxes Payable | $8,000 | Deferred tax payments contributing to cash flow |

| Net Cash From Operations | $126,600 | Indicator of primary cash-generating activities |

| Equipment (Investing Activities) | ($73,000) | Capital expenditures, reflecting long-term investment |

| Notes Payable (Financing Activities) | $10,025 | Cash inflow from financing activities |

| Net Cash Flow (2020) | $63,625 | Sum of operational, investing, and financing cash flows |

| Net Increase in Cash | $63,625 | Equal to net cash flow, indicates liquidity status |

Operations brought in a strong $126,600. But buying equipment lowered the net cash, showing long-term investments. This isn’t always clear from income statements.

Comparing Cash Flow to Sales ratios from 2020 (6%) to 2019 (13%) shows a need for deeper review of sales and how efficiently cash is generated. The Operation Index, a made-up measure here, helps understand the link between cash flow and profit, giving deeper insights into financial statements.

Looking at the Supplemental Information often uncovers more data. It can show things like non-cash transactions or other cash flow details. This info helps get a full understanding and spot any one-time impacts on finances.

Breaking Down the Balance Sheet for Better Business Understanding

Trying to understand balance sheets seems hard at first, but knowing its parts and their connections can show a company’s financial health.

A company’s assets are split into categories like current assets, fixed assets, intangible assets, financial assets, and prepaid expenses. Each one plays a different role in a company’s health and how it runs.

Current assets should turn into cash within a year and include things like inventory. On the other hand, fixed assets are things like buildings, used long-term and depreciate over time.

Companies have to pay current liabilities, such as taxes and salaries, within a year. But non-current liabilities include longer debts, lasting more than a year.

The equity part shows the value left after taking off liabilities from assets. This figure changes as the company grows. It includes earnings kept after paying dividends.

The current ratio, from dividing assets by liabilities, tells if a company can pay its short-term bills. The debt-to-equity ratio shows how much debt is used over shareholder equity.

The rules of financial accounting, like accounting principles and accounting standards, help present the balance sheet. Understanding these rules is essential to get the balance sheet’s full picture.

Knowing these principles and standards will help you check a business’s financial health better.

Profit and loss statements add more to the story, showing revenues and expenses. They help track a company’s financial actions over time and highlight how well it’s doing.

A balance sheet shows a company’s financial status at one point. But combining it with income and cash flow statements gives a full view of financial health. To truly understand financial stability and growth, learning from all financial statements is crucial.

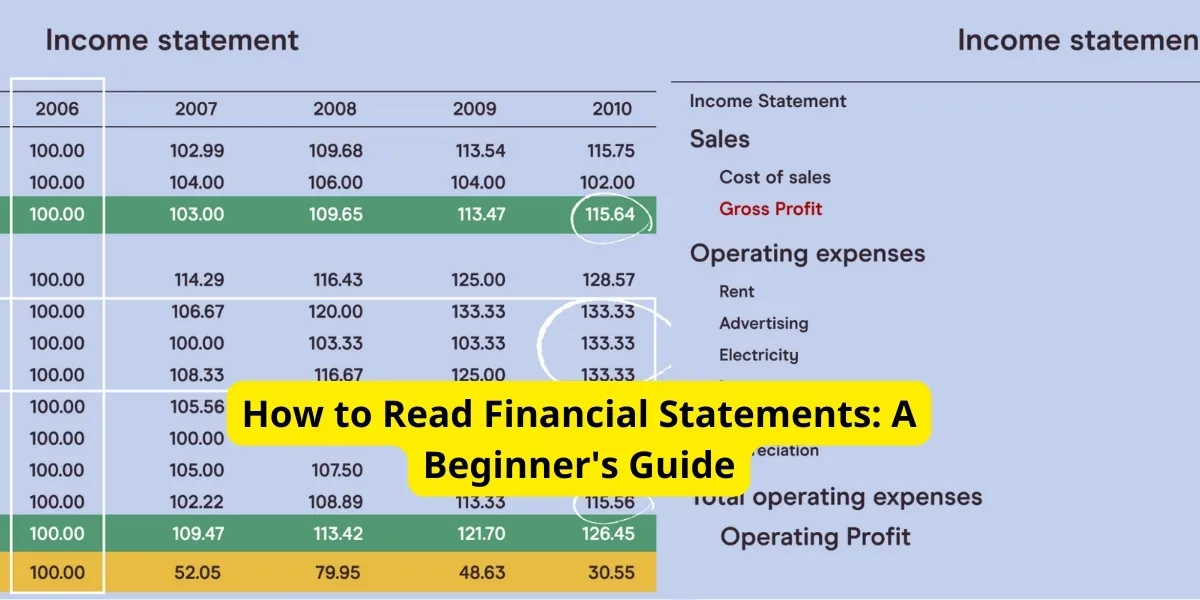

Income Statement Analysis: Evaluating Profitability and Cost Management

Analyzing an income statement helps us see how well a company is doing financially. It shows us if a company makes money and how well it handles its costs. Known also as a profit and loss statement, it details how income turns into net earnings. This tells us how efficiently a business is running.

From Revenue to Net Income: Understanding the Flow

Revenue is crucial for any business. It’s the money made from selling goods or services. After starting with revenue, the statement deducts expenses like cost of goods sold and operating costs. What’s left is called EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This shows profit before other costs like taxes are applied.

After taking out interest, taxes, and extra costs, we get to net income. This number shows the company’s final profit. Investors and analysts also look at earnings per share (EPS). EPS tells us how much profit each share of stock earns.

Assessing Business Performance Through Key Indicators

Reviewing an income statement lets managers and investors compare profits to others. This comparison helps show if a firm is doing well financially. By looking at profits, companies can make smarter decisions to improve their performance.

An income statement talks about profits, but it’s different from cash flow. For a complete financial picture, you also need the cash flow statement. Together, these reports show a company’s financial state, including how it manages money and pays debts.

For nonprofits, the income statement has a different name: the Statement of Activity. Its formula, Revenues – Expenses = Change in Net Assets, follows special accounting rules. These rules help show the financial health of nonprofits differently from for-profit businesses.

Getting from revenue to net income shows how costs are handled and the effect of accounting choices. Choices like using the cash method or accrual accounting can change how income is reported. This knowledge is key for understanding a company’s finance.

Being good at reading an income statement helps you see a business’s profit situation. It aids in planning and making decisions for future success and stability.

Uncover the Story Behind the Numbers in Annual Reports

Many see an annual report just as numbers and a legal document for the Securities and Exchange Commission (SEC). But, it’s more. It connects shareholders’ equity and retained earnings to a company’s real ambitions. The 10-K and its annual report are not just for compliance. They tell the detailed story of a company’s journey in business and finance.

An annual report is full of valuable insights. It shows how decisions are made beyond just the numbers. Through letters from executives and management’s analysis, you get the goals and dreams behind the numbers. This makes the report more than just data.

Deciphering CEO Letters and Management Discussions

CEO letters share last year’s achievements and the goals for the next. They talk about strategies and how the company has faced ups and downs. They also explain how numbers reflect bigger economic or industry changes. These letters are key for both new investors and experts. They help judge the company’s future success.

Linking Financial Data to Company Goals and Market Position

Annual reports do more than just give data. They tell a story of the company’s place in the market and its plans for growth. A rise in retained earnings or strong shareholders’ equity shows the company’s long-term vision and short-term targets. These reports highlight a company’s strength and how it adapts to changes in business.

| Year | Net Revenues | Net Earnings | EPS | ROE | ROTE | Book Value per Share Growth |

|---|---|---|---|---|---|---|

| 2022 | $47.4 billion | $11.3 billion | $30.06 | 10.2% | 11.0% | 6.7% |

Looking into annual reports reveals achievements and goals. It compares past financial successes to future hopes. By blending numbers with stories, we get a full picture of where the company is headed. This is vital for anyone interested in the company’s future.

Grasping the Foundations of Financial Reporting Standards

Understanding financial reporting basics is key for anyone who wants to accurately read financial statements. The Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB) lead the way in setting standards. It’s crucial to know both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

GAAP is known for being thorough and detail-focused, while IFRS is recognized worldwide. This makes it easier for investors and analysts to compare financials from different countries. When you look into financial statements, noticing the differences in how assets are handled, depreciation methods, and inventory reporting is key for in-depth financial analysis.

A major report was given to US financial committees to improve these standards, prepared by the U.S. Securities and Exchange Commission staff. They examined the idea of principles-based accounting standards. This idea came from the Sarbanes-Oxley Act of 2002, aiming to strengthen financial reporting and boost investor confidence through better oversight.

The Act led to a deep dive into how standards are set, revealing issues in both rules-based and principles-only standards. This resulted in important suggestions for the future of accounting standards.

The report suggested creating standards based on a solid conceptual framework, emphasizing the accounting goal, and fixing inconsistencies. It also said to reduce exceptions and remove rigid percentage tests.

- CEO and CFO certification to confirm the accuracy of financial reporting.

- Boosting the power of audit committees to monitor financial disclosures and audits.

- Ensuring stricter auditor independence for unbiased and fair reporting.

- Better oversight by the Public Company Accounting Oversight Board.

- A study on the role of investment banks in earnings manipulation.

These recommendations push for a standard-setting approach that focuses on objectives, not just rules. This makes financial reporting more transparent and true to its purpose. Keep in mind that a rules-based approach can lead to reporting that misses the mark, showing the importance of careful judgment.

| Aspect | Objective | Characteristics |

|---|---|---|

| Optimal Principles-Based Standard | Accurate financial representation | Concise principles, specified objectives, minimal exceptions, detailed guidance, no bright-line thresholds, conceptual framework alignment. |

| Imperative For Enhanced Reporting | Improving interpretative clarity | Objectives-oriented setting, negating rule circumvention, greater consistency in application. |

The Role of Financial Statement Notes and Supplementary Information

Understanding financial statement notes and supplementary information is key in financial analysis. They add context to the financial data and provide auditors’ opinions. These opinions are important for checking the data’s accuracy.

Since December 15, 2010, auditors have followed section 2237. They check if the supplementary information fits well with the main financial statement account. This is essential for audits, and it must follow GAAP strictly. Supplementary information helps users understand the main financial statements better.

Interpreting Auditors’ Insights for Enhanced Analysis

The review process for supplementary information is thorough. Auditors make sure the information is “fairly stated, in all material respects”. They also check the management’s accountability for the extra data. Once the main financial statements are out, auditors aren’t responsible for changes that affect the supplementary information.

Understanding the Impact of Non-Financial Factors on Financial Statements

Non-financial information like market trends and technology adds insight into a company’s performance. This kind of information, along with financial data, gives a full picture of a company’s health.

Now, let’s look at how financial statement notes and supplementary information are used in the real world:

| Component | Description | Users | Purpose |

|---|---|---|---|

| Balance Sheet | Lists assets, liabilities, and equity at a specific point. | Investors, financial institutions | To assess liquidity and financial stability. |

| Income Statement | Shows revenue and expenses over a period. | Managers, stockholders | For evaluating operational success and profitability. |

| Statement of Changes in Equity | Reflects changes in owners’ equity. | Prospective investors | To understand shifts in ownership and investable value. |

| Cash Flow Statement | Details cash inflow/outflow from operations, investing, and financing. | Employees, owners | To gauge cash generation effectiveness. |

Creating financial statements according to IFRS is crucial for transparency. It ensures consistency across different areas. This builds confidence and accountability among stakeholders.

Conclusion

The art of financial statement audits is crucial for maintaining public companies’ integrity. These audits are especially important for companies trading on stock exchanges. By improving how you analyze financial statements, you get better at understanding complex financial stories.

This boosts your financial analysis skills. Recognizing that companies follow GAAP is key. This practice allows for uniform financial statements. This uniformity is crucial for comparisons and evaluations by various stakeholders.

Auditors follow GAAS to evaluate the trustworthiness of financial information. When they give an unqualified opinion, it means the financial statements appear accurate. This enhances your trust in making smart financial decisions. Yet, it’s important to know that disagreements might lead to modified opinions.

These disagreements are vital financial statement key terms to understand. They can impact how you view investments.

Being skilled at reading income statements, understanding balance sheets, and analyzing cash flow statements is empowering. It allows you to examine a company’s financial well-being closely. Public and large private companies serve many stakeholders, from investors to regulators. Armed with this expertise, you can approach financial statements with the insight needed for deeper analysis and strategic planning in corporate finance.

FAQ

How can I begin to read financial statements effectively?

Begin by learning about the balance sheet, income statement, and cash flow statement. Know what each part means and how they connect. Use tools from financial courses or FASB publications to help.

Why are financial statements crucial in business analysis?

They show a company’s financial health and its efficiency and profit. This makes them key for checking out investments and making business plans.

What is the key to effective cash flow analysis?

Know how the cash flow statement works. It shows cash coming in and going out. This tells you if a company can pay bills and grow.

How do I decipher a company’s balance sheet?

Look at assets, liabilities, and shareholders’ equity. See what they say about the company’s money and health. Compare them to industry norms and past performance.

What should I focus on when evaluating an income statement?

Check the revenue, expenses, and profits. Look at Gross Margin, Operating Income, and EPS. These show if the company makes money and is run well. Also, consider how non-cash costs like depreciation affect profits.

How do I interpret the qualitative information in annual reports?

Read the CEO’s letter and management’s discussion. Look at the notes too. They give you the story behind the numbers, like plans and market challenges. This helps understand the company better.

What are the differences between GAAP and IFRS?

GAAP and IFRS are different accounting rules. They differ in handling sales, inventory, assets, and reports. Knowing these differences is key for comparing companies in different countries.

Why are notes to financial statements important?

Notes give details not in the main financials. They explain accounting methods, estimates, legal issues, and more. These can change how you see a company’s finances.

How does non-financial information impact financial statement analysis?

Information on the market, competition, laws, and management affects finances. Knowing this gives a fuller picture and helps explain financial changes.

What are the key terms I should know for reading income statements?

Understand terms like Revenue, COGS, Gross Profit, and Net Income. Also, know about EBIT, EBITDA, and Non-operating Expenses. These help you grasp a company’s financial health.

Source Links

- https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/understanding-balance-sheets

- https://www.business.govt.nz/business-performance/strategic-finance/how-to-read-financial-statements/

- https://en.wikipedia.org/wiki/Financial_statement

- https://www.investopedia.com/terms/f/financial-statement-analysis.asp

- https://www.abc-amega.com/articles/understanding-the-cash-flow-statement/

- https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/templates-business-guides/glossary/balance-sheet

- https://www.extension.iastate.edu/agdm/wholefarm/html/c3-24.html

- https://nasaa-arts.org/wp-content/uploads/2017/03/Reading-5-Understanding-Financial-Statements.pdf

- https://www.goldmansachs.com/investor-relations/financials/current/annual-reports/2022-annual-report/

- https://www.sec.gov/news/studies/principlesbasedstand.htm

- https://us.aicpa.org/content/dam/aicpa/research/standards/auditattest/downloadabledocuments/au-00551.pdf

- https://www.pwc.com/im/en/services/Assurance/pwc-understanding-financial-statement-audit.pdf