The GAAP hierarchy is a crucial framework for financial reporting standards in the United States. Established by the Financial Accounting Standards Board (FASB), it guides companies in preparing financial statements. The hierarchy ensures consistency and clarity in accounting practices, benefiting investors, regulators, and other stakeholders. Understanding the GAAP hierarchy is essential for finance and accounting professionals to maintain compliance and provide accurate financial information.

AdvertisementKey Takeaways

- The bedrock of GAAP hierarchy is paramount for uniform financial reporting.

- FASB’s accounting standards codification is a navigation tool for over 90% of its adept users.

- Codification includes diverse literature from various standard setters effective post-September 15, 2009.

- US GAAP hierarchy effectively supersedes all earlier GAAP standards, heralding a new era in accounting.

- Exclusion of state and local government standards signals the Codification’s tailored applicability.

- Significantly different structures have emerged in the new Codification compared to previous standards.

What is the GAAP hierarchy?

The GAAP hierarchy is a system of accounting rules used in the U.S. It applies to private companies, non-profits, and government entities. These guidelines are ranked by their authority. This setup ensures consistent financial reports.

The Foundation of Financial Reporting: Exploring GAAP Hierarchy

The Financial Accounting Standards Board (FASB) plays a key role in financial accounting in the U.S. It uses a set hierarchy to ensure clear and reliable financial reports. The top level of this hierarchy helps make financial reporting accurate and trustworthy.

Documents like FASB Technical Bulletins and AICPA Practice Bulletins tackle specific accounting issues. They help make financial statements clear and uniform. AICPA Accounting Interpretations also provide guidance, filling in when primary sources don’t give clear answers.

Updates from the FASB continuously improve financial standards. ASU No. 2018-08, for example, updated revenue recognition to match new industry norms. ASU 2016-02 changed how leases are reported, pushing for more openness.

Since 1973, the Financial Accounting Foundation has supported the FASB. Notable updates include ASU 2016-13, which introduced a new way to account for credit losses. ASU 2016-14 made it easier for non-profits to classify their net assets.

Lastly, FASB’s work, including the pivotal ASU 2014-09 about revenue from contracts, shows its goal to improve financial reporting. These updates ensure that the principles of GAAP remain strong and relevant in today’s economy.

Deconstructing the Layers of GAAP Hierarchy

The GAAP hierarchy is a strong structure. It arranges the fasb accounting standards and other accounting standards. This helps companies and accountants make sure their financial reporting follows rules. Both government accounting standards and the fasb accounting standards codification are key to this system. It guides them through the complex world of finance.

A report from JPMorgan Chase & Co. shows how GAAP is used in real life. The bank’s handling of its finances was top-notch as of December 31, 2009. They followed GAAP’s most important rules without missing anything.

JPMorgan Chase & Co.’s money made jumped significantly from 2008 to 2009. It went from $67,252 million to $100,434 million. This highlights how crucial strict financial reporting is. They used technical bulletins, a part of GAAP, to tackle complex money matters.

The money set aside for unexpected losses also showed a big increase. For JPMorgan Chase & Co., it jumped from $6,864 million in 2007 to $32,015 million in 2009. This might show a deeper use of tertiary guidelines gaap for certain financial situations.

The bank’s overall money health got better, with net income rising to $11,728 million. Earnings per share also went up from $1.35 in 2008 to $2.27 in 2009. But, money given back to shareholders dropped from $1.52 in 2008 to $0.20 in 2009. These financial moves are guided by the fasb accounting standards. They influence how companies report their finances within GAAP.

The drive for better accounting is seen worldwide. International groups debate new accounting ideas, making both GAAP and IFRS standards better. The talks also focus on how to document financial tools better. The aim is clear, responsible financial talking.

History shows the value of long-term trust between companies and auditors. For example, KPMG has worked with JPMorgan Chase since 1992. Their work shows the trustworthiness GAAP asks for. Also, big investments in 2022, like in tracks and railways, show careful reporting under strict standards.

Learning about the GAAP hierarchy shows its key role in finance and rule-following. It helps places like JPMorgan Chase & Co. stay true and clear in their finances.

Applying GAAP Hierarchy to Real-World Accounting

The FASB accounting standards are making sure financial reports are precise. They help accountants and financial experts give clear and correct financial details. This makes financial statements reliable and trustworthy.

Precise Financial Statement Preparation

Accurate financial reports are the foundation of trust in finance. Using generally accepted accounting principles GAAP helps ensure this accuracy. It’s important to keep up with FASB’s latest rules to stay accurate.

Compliance with Regulatory Accounting Standards

Regulatory accounting means following certain rules. Companies need to follow FASB Codification and the SEC’s disclosure rules. This keeps their financial reporting on the right track.

Comparative Analysis of IFRS vs GAAP

A deep dive into IFRS vs GAAP shows how global finance works. It brings out the differences in international finance. This helps understand the unique aspects of U.S. GAAP better.

| Aspect | Generally Accepted Accounting Principles (GAAP) | International Financial Reporting Standards (IFRS) |

|---|---|---|

| Objectivity | Varying level of detail, adherence to framework | Focus on economic substance |

| Development | Principles-based, objectives-oriented approach | Principles-based, minimal exceptions |

| Implementation Guidance | Sufficient with explicit objectives | Global applicability with broad guidelines |

| Regulatory Influence | SEC oversight, Public Company Accounting Oversight Board | International Accounting Standards Board (IASB) recommendations |

FASB’s updates show how financial reporting is evolving. The introduction of U.S. GAAP in XBRL and new ASUs are examples. After the Sarbanes-Oxley Act, the SEC suggested focusing on objectives. This helps gain investors’ trust and improves financial statements.

Conclusion

In the world of finance, following a clear hierarchy is essential. The GAAP hierarchy is key for financial reporting and accounting in the US. It relies on principles from the FASB to make sure financial statements are dependable.

Since 1975, the GAAP hierarchy has evolved significantly. This shows the accounting field’s dedication to meeting regulations and earning public trust. FASB and GASB update their guides regularly, reflecting changes in both US and international financial reporting worlds. It’s vital for companies and professionals to stay up-to-date with these developments.

GASB works hard to improve governmental accounting through updates like Statement no. 34. This effort changes how financial health is viewed and shared by governments. The GASB and FASB are crucial for high-quality, future-proof accounting standards. These standards aim to align more closely with international practices. Keeping up with these institutions’ changes ensures our economic system remains transparent and reliable.

FAQ

Who is responsible for establishing and maintaining the GAAP hierarchy?

The Financial Accounting Standards Board (FASB) maintains the GAAP hierarchy. It works under the Financial Accounting Foundation (FAF). The FASB ensures that financial reports accurately reflect business.

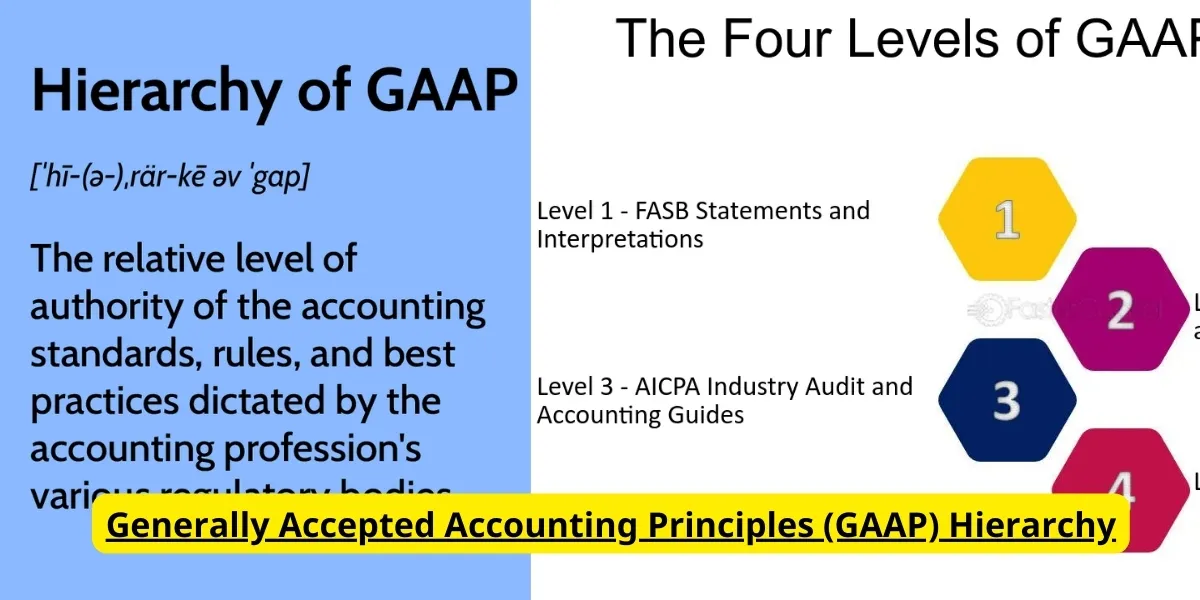

What are the levels of authority within the GAAP hierarchy?

The GAAP hierarchy has four levels. Level 1 includes FASB Statements and Interpretations. Level 2 has FASB Technical Bulletins and AICPA Practice Bulletins. Next, level 3 includes AICPA Accounting Interpretations and SEC Staff Accounting Bulletins. Lastly, level 4 covers industry practices and publications.

Why is the GAAP hierarchy important for financial reporting?

The GAAP hierarchy helps create reliable financial statements. It allows everyone to make informed decisions. This system also ensures companies follow rules and apply accounting principles correctly.

How does the GAAP hierarchy relate to the Financial Accounting Standards Board (FASB)?

FASB leads the GAAP hierarchy. It issues important accounting standards and updates them. This keeps financial reporting up-to-date and addresses new challenges.

Can companies choose which GAAP guidelines to follow?

No, companies can’t pick their preferred GAAP guidelines. They must use the most authoritative rules for their financial issues. This ensures all entities using GAAP report finances uniformly.

What role do the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB) play in the GAAP hierarchy?

The SEC oversees public company reports, endorsing the FASB standards. The PCAOB checks public company and broker-dealer audits. Together, they ensure transparent and GAAP-compliant financial reporting.

How does the FASB’s Accounting Standards Codification fit into the GAAP hierarchy?

The FASB Accounting Standards Codification is the top level of the GAAP hierarchy. It combines all GAAP standards into one structure. This is the main reference for U.S. accountants.

Is the GAAP hierarchy static, or does it evolve over time?

The GAAP hierarchy changes as finance and economies evolve. The FASB introduces new standards when needed. This keeps financial reporting relevant and accurate.

How do the Generally Accepted Accounting Principles (GAAP) differ from the International Financial Reporting Standards (IFRS)?

GAAP and IFRS have various differences, such as in revenue recognition and inventory costing. The U.S. uses GAAP, while many other countries use IFRS. Understanding these differences is vital for global businesses and investors.

Source Links

- https://asc.fasb.org/layoutComponents/getPdf?isSitesBucket=true&fileName=FASB_About_the_Codification.pdf

- https://www.aicpa.org/interestareas/frc/accountingfinancialreporting.html

- https://www.jpmorganchase.com/content/dam/jpmc/jpmorgan-chase-and-co/investor-relations/documents/2009AR-Consolidated-Financial-Statements-Notes.pdf

- https://www.ifrs.org/content/dam/ifrs/news/updates/iasb/2006/dec06.pdf

- https://www.cn.ca/-/media/files/investors/investor-financial-quarterly/investor-financial-quarterly-2022/q4/2022-full-year-statements-en.pdf

- https://en.wikipedia.org/wiki/Generally_Accepted_Accounting_Principles_(United_States)

- https://www.sec.gov/news/studies/principlesbasedstand.htm

- https://www.cfo.com/news/fasb-reexamines-gaap-hierarchy/677981/

- https://www.journalofaccountancy.com/issues/2007/jun/closingthegapsingaap.html